Just How a Bookkeeper Improves Financial Management for Business Owners

An accountant plays a vital function in improving monetary administration for business owners. By properly taping deals and fixing up statements, they offer clearness and structure to monetary procedures. This well organized strategy not just aids in compliance yet additionally supports strategic decision-making. As entrepreneurs browse their growth trips, the effect of reliable accounting ends up being increasingly considerable. What specific advantages can business owners expect when they utilize professional accounting solutions?

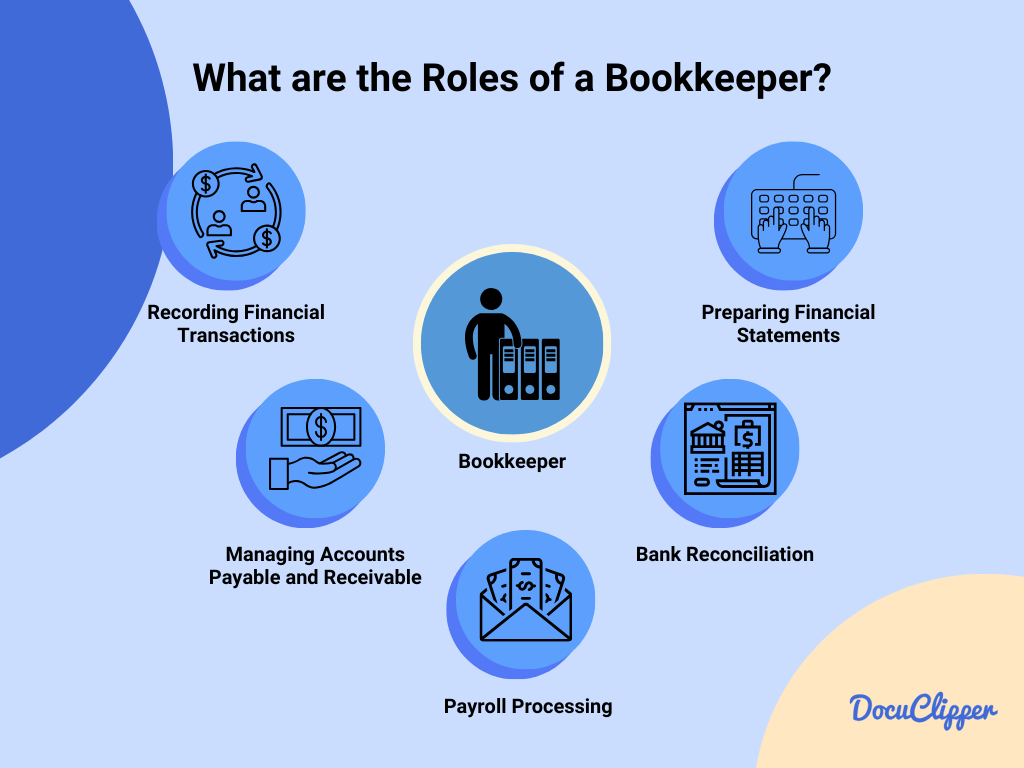

The Function of an Accountant in Financial Monitoring

Several individuals may not understand it, an accountant plays a crucial function in the monetary monitoring of a company. They diligently videotape all monetary deals, guaranteeing that income and costs are properly recorded. This foundational task allows local business owner to comprehend their economic standing at any given moment. An accountant also resolves bank declarations, which aids recognize discrepancies and warranties that the company's economic documents straighten with real financial institution information.

They prepare economic reports, such as profit and loss statements, which supply understandings into the organization's performance over time. By arranging and preserving economic documents, a bookkeeper allows entrepreneurs to make educated decisions based upon trustworthy information. Their proficiency in managing accounts payable and receivable further aids in maintaining healthy and balanced cash circulation. Basically, a bookkeeper works as an important support system, permitting entrepreneurs to concentrate on growth while guaranteeing economic precision and conformity.

Time-Saving Perks of Specialist Accounting

Professional bookkeepers utilize sophisticated software and systems to improve processes such as invoicing, cost monitoring, and financial reporting. This efficiency reduces the moment invested in hand-operated access and decreases the likelihood of errors that can need additional time to correct. In addition, an accountant can develop regimens for routine economic updates, making certain that entrepreneur obtain prompt insights without the need to check out the minutiae themselves. Inevitably, the time saved can equate right into greater productivity and enhanced total company performance.

Guaranteeing Compliance and Reducing Economic Threats

Exactly how can a company warranty conformity with ever-changing financial policies while minimizing risks? Involving a professional bookkeeper can considerably boost this procedure. A competent bookkeeper stays informed regarding the most up to date tax obligation laws and economic guidelines, making certain that an organization follows essential conformity standards. This positive method aids stop costly penalties and legal problems that might emerge from non-compliance.

An accountant applies robust interior controls to mitigate monetary threats. By establishing balances and checks, they reduce the chance of errors or illegal activities. Bookkeeping Calgary. Normal audits and reconciliations carried out by an accountant supply an extra layer of safety, determining disparities prior to they intensify

In addition, exact record-keeping and timely reporting make it possible for entrepreneurs to make enlightened decisions and expect prospective financial issues. Eventually, a professional accountant works as a crucial property in cultivating an economically secure atmosphere, allowing entrepreneur to concentrate on growth and advancement.

Getting Accurate Financial News for Informed Decision-Making

Precise economic coverage is crucial for organizations intending to make enlightened choices, as it gives a clear image of more info their economic health and wellness. A competent accountant plays a crucial duty in creating these reports by diligently tracking revenue, expenditures, and total cash money flow - Best Bookkeeping Calgary. Through thorough record-keeping, bookkeepers assure that all economic purchases are accurately recorded, which creates the backbone of trustworthy coverage

With exact data compilation, accountants can create vital financial records such as balance sheets, income declarations, and cash circulation statements. These files not just light up present monetary standings however likewise highlight fads that might influence future choices. In addition, by making use of accountancy software application and sticking to finest practices, accountants can decrease the probability of errors, consequently enhancing the trustworthiness of the records. Ultimately, exact financial records encourage business owners to make strategic selections that straighten with their service purposes, promoting confidence in their monetary monitoring.

Supporting Business Growth and Strategic Planning

As businesses seek to adapt and broaden to transforming markets, reliable financial administration becomes important for sustaining growth and calculated planning. A competent accountant plays a pivotal role in this procedure by maintaining arranged economic documents and tracking capital accurately. This enables entrepreneurs to determine fads, assign sources efficiently, and make educated choices about investments and scaling operations.

A bookkeeper aids in spending plan preparation and financial forecasting, giving understandings that align with the firm's long-lasting goals. By analyzing economic data, they can highlight locations for enhancement and recommend techniques to improve success. Additionally, their proficiency in conformity warranties that services remain lined up with governing requirements, decreasing risks related to financial mismanagement.

Basically, a proficient accountant is a very useful possession, encouraging business owners to concentrate on development initiatives while maintaining a solid economic foundation that supports calculated planning. (Bookkeeping Calgary)

Regularly Asked Concerns

What Certifications Should I Look for in a Bookkeeper?

When selecting an accountant, one should focus on certifications such as appropriate certifications, experience in the sector, proficiency in accounting software program, focus to detail, and strong organizational abilities to guarantee accurate financial management and coverage.

How Much Does Hiring an Accountant Normally Price?

Hiring an accountant commonly costs between $20 to $100 per hour, depending upon their experience and the complexity of the financial tasks. Regular monthly retainers may additionally use, ranging from a couple of hundred to numerous thousand bucks.

Can a Bookkeeper Aid With Tax Prep Work?

Yes, an accountant can assist with tax obligation prep work by arranging financial documents, ensuring conformity with tax regulations, and giving necessary documents to simplify the declaring process, inevitably reducing the problem on the business owner throughout tax period.

Just how Commonly Should I Satisfy With My Accountant?

Meeting with an accountant must take place month-to-month for routine financial evaluations, while quarterly meetings are ideal for evaluating more comprehensive financial methods. Extra frequent conversations might be helpful during busy durations or significant economic modifications.

What Software Program Do Bookkeepers Commonly Use?

Bookkeepers commonly utilize software such as copyright, Xero, and FreshBooks for handling finances. These tools promote invoicing, cost tracking, and economic coverage, permitting organized and effective financial administration in various organization setups.